Cheques mailed after September 19

If you mailed a cheque after September 19 for the September 29 tax due date, please monitor your bank account to confirm the cheque has been received. If your cheque has not been received due to the Canada Post strike action, we recommend making payment through an alternate method (in-person at your bank or City Hall, drop boxes at City Hall or online). Once the City receives any delayed mail from Canada Post, the City will review accounts before processing cheque payments to ensure they should still be deposited.

If you mailed a cheque after September 19 for the September 29 tax due date, please monitor your bank account to confirm the cheque has been received. If your cheque has not been received due to the Canada Post strike action, we recommend making payment through an alternate method (in-person at your bank or City Hall, drop boxes at City Hall or online). Once the City receives any delayed mail from Canada Post, the City will review accounts before processing cheque payments to ensure they should still be deposited.

The majority of the City's money comes from residential and commercial property taxes. Other sources of revenue include user fees, development charges, grants & subsidies from other levels of government and contributions from reserves.

Residential property tax bill funds are allocated to City services, education, and the City’s service partners. Learn about where your money goes.

Property Tax Billing Notices

Tax billing notices are mailed to property addresses unless otherwise advised. If you would like these notices mailed to a different address, please complete and submit a Mailing Address Change Form. This will only change your mailing address with the City of Barrie. You must also provide mailing address changes to MPAC.

Property taxes are billed by the City of Barrie twice per year: the interim bill and the final bill, with two payment instalments due for each billing. If Tax Arrears appears on your tax bill it means that at the time of billing there is an outstanding balance on the account. All payments must be received by the City by the due date to avoid late payment charges of 1.25% per month (calculated starting on the first day of each month payment is delayed).

Property taxes are calculated based on the assessment value of your property, which is determined by the Municipal Property Assessment Corporation (MPAC). If you have any concerns about your assessed value or classification, please refer to aboutmyproperty.ca.

Interim tax bill

Interim 2025 tax bill instalment due dates: February 28 and April 30, 2025.

The interim bill is issued each January. Property owners who have taxes paid via their mortgage company, or who are on a pre-authorized payment plan, do not receive an interim tax bill.

The Municipal Act requires that your interim bill be based on 50% of your prior year taxes adjusted by any completed supplementary or assessment cancellations. The interim bill is an estimate because the City and Service Partners budgets, and Provincial Education tax rates are not yet confirmed (the final tax bill is adjusted to the current year tax rates).

Final tax bill

Final 2025 tax bill instalment due dates: June 30 and September 29, 2025.

The final bill is issued each May and may arrive in mailboxes in early June. It is calculated using your assessed value and the Council-approved tax rates for the current year, less the interim bill amount.

There may have been an update to your property’s assessment value based on some type of change/improvement to your property. Your final 2025 tax bill reflects any changes to the assessed value of the property in the past year as it is calculated using your 2025 assessment value and the City’s 2025 tax rate. Your interim tax bill sent out earlier this year was based on 50% of the taxes you paid last year and would not be indicative any assessment increases.

Pre-authorized payment (PAP) notification letters regarding property taxes are mailed each December to taxpayers registered on a monthly PAP plan. PAP notification letters function as a receipt for the previous year and specify the first five withdrawals for current year, from January to May. Those who receive a PAP notification letter do not receive an interim tax bill. There is a $15 fee for a replacement receipt (available by contacting Service Barrie); it is recommended this letter be kept for your records.

Tax Arrears notices are issued to property owners when payment due to the City has not been paid. Interest/penalty is calculated at a rate of 1.25% per month on the first day of each month payment is delayed. The notice outlines tax amount due, interest/penalty amounts, and payment options. Interest/penalty fees cannot be waived. Properties that are two or more years in arrears are eligible to be registered for tax sale.

FAQs re Tax Arrears Notices

I've paid my taxes in full. Why did I receive a tax arrears notice? Tax arrears notices are automatically generated to any account with an overdue balance.

Please note that if you paid your property taxes via your bank or by credit card close to or on the due date, the payment may not have been received in time and could result in an arrears notice being generated.

In addition to overdue property taxes, other reasons for arrears include:

- Overdue water/wastewater bills transferred to tax roll (owner or tenant account linked to property address)

- New account fee for ownership changes

- Overdue property standards fines transferred to tax roll

- Unpaid fees for duplicate tax bills or tax receipts

If your taxes were paid in full, it's possible that one or more of the above charges were added to the tax roll. Please contact Service Barrie at (705) 726-4242 or ServiceBarrie@barrie.ca so a representative can review your account and provide you with full information.

I have moved from this property. Why am I getting this notice? Please disregard the notice. Taxes will be updated and notices sent to the new owner once the ownership information has been received and updated. I have already made this payment. What should I do? The payment may have made around the time of arrears letters being generated and mailed. Please contact Service Barrie at (705) 726-4242 or ServiceBarrie@barrie.ca so a representative can review the account history for payment. Please be prepared to supply proof of payment (i.e. cancelled cheque, online banking confirmation number) if requested. My mortgage company pays the property taxes. Why am I getting this notice? Please contact your mortgage company to determine why payment was not made by the due date. The Municipal Property Assessment Corporation (MPAC) sends Property Assessment Change Notices throughout the year as changes to your property occur. Reasons you will receive a Property Assessment Change Notice include:

- A change to your property, such as an addition, new construction or renovation

- A structure on your property was assessed for the first time

- A change to your property’s classification

- All or part of your property no longer qualifies as farmland, conservation land or managed forests

- All or part of your property no longer qualifies to be tax exempt

Property tax dollars associated with any changes are retroactive to the date of occupancy or when the renovation or alterations were completed.

Assessment increases that occur after the annual assessment roll has been returned are liable for property taxation. This form of tax billing is referred to as "supplementary" for the current year, or "omitted" when there were increases from prior years that were not captured in the year in which they applied. In these cases, MPAC can issue an omitted assessment going back two preceding years.

Supplementary/omitted tax bills are issued by the municipality after final billing. The tax bill(s) will have a separate due date(s) and will not be included in tax payment plans. As per the Municipal Act, 2001, the supplementary/omitted tax bills will be mailed to residents at least 21 days prior to the due date(s).

The supplementary/omitted bill(s) is in addition to what has been previously billed on the property. This bill does not include payments already made to your tax account or future installments that have been previously billed and are still outstanding.

Property Tax Payment Options

The City encourages property owners to join the Pre-Authorized Payment Plan for a convenient, worry-free and secure way to pay property taxes.

The PAP Plan authorizes the City to automatically withdraw funds from the bank account you designate to make tax payments. There is no surcharge for this method of payment. Benefits include:

- No worry about missed due dates

- In the event of postal disruption, illness or vacation, your payments will still be made

- Monthly plan allows easier budgeting

- Savings on postal charges

- Once you have enrolled in a plan, you do not have to reapply for subsequent years

There are three plan options:

- Monthly PAP Plan

For properties that are NOT in arrears - Due Date PAP Plan

For properties that are NOT in arrears - Arrears PAP Plan

For properties that have tax arrears

Payment can be made online or by telephone with your bank. To pay online, you’ll need to add the City as a payee. Search for “Barrie” to add the City as a payee. Your 19-digit roll number, found on your tax bill, is your account number.

Please allow enough time for payments to be received prior to the due date. Payments made via bank may take several business days.

Credit card payments are not accepted directly by the City of Barrie. However, property taxes can be paid online by credit card using an online bill payment service provider.

The service provider may charge service fees and there may be restrictions on the types of credit cards accepted. The City of Barrie receives only the billed tax amount. Payment is processed by the City on the date we receive the funds which may be a few days after payment is made. Please allow enough time for payments to be received prior to the due date. Refer to the service provider’s website for terms and conditions of their service, charges and payment processing times.

Service Barrie

Payment (cash, cheque or debit) can be made in person at Service Barrie (first floor of City Hall, 70 Collier Street) during regular business hours: 8:30am–4:30pm Monday–Friday (excluding holidays). Credit cards are not accepted directly as a payment method. Please refer to the information above regarding making a payment online via your credit card.

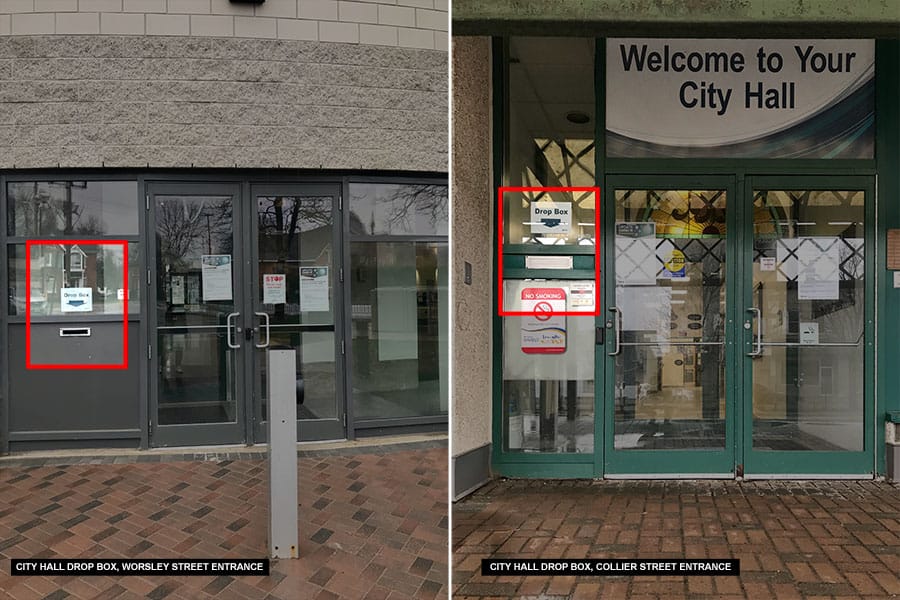

City Hall Drop Boxes

Payment can also be made by dropping off a cheque to City Hall drop boxes, located at the front entrance at 70 Collier Street or the entrance at Worsley Street parking lot.

Image

Bank Branches

Payment can also be made in person at your bank branch. Your 19-digit roll number, found on your tax bill, is your account number. Please allow enough time for payments to be received prior to the due date. Payments made via bank may take several business days.

Payment can be made by mailing a cheque to Service Barrie, P.O. Box 400, Barrie, ON, L4M 4T5. The cheque should be payable to the City of Barrie (i.e. write "City of Barrie" on the cheque). Please allow enough time for payments to be received prior to the due date.

*As announced on October 10, 2025, Canada Post customers should expect delays due to the Canadian Union of Postal Workers (CUPW) rotating strikes. Property owners/residents are still obligated to pay property taxes, so residents are encouraged to make payments using alternate methods.

Please note that if your taxes are paid by a mortgage company, you will not receive an interim bill. If you do receive an interim bill, please contact your mortgage company. You will receive a Final property tax bill for your records in May.

Property Tax Rebate, Adjustment, & Deferral Programs

Charitable organizations, property owners aged 65 or older, and any individual who is currently receiving benefits under the Ontario Disability Support Program may be eligible for a property tax rebate or deferral. Owners of properties that experienced a change during the year may be eligible for a tax adjustment.

If you operate a registered charity or similar organization, you may be eligible for a rebate of 40% of the property taxes paid if you meet the eligibility requirements.

You may file an application with the City of Barrie (Treasurer) requesting your taxes to be reduced or refunded, under Section 357, 358 of the Municipal Act, 2001, if your property experienced a change during the year.

The Property Tax Deferral Program is available to any property owner aged 65 or older and/or any individual who is currently receiving benefits under the Ontario Disability Support Program. Eligible applicants will have their property taxes “frozen” at their base year amount (the year prior to the application.)

Property Tax Rates & Fees

Council Motion 25-G-080 established the tax rates to be used in determining the municipal portion of your 2025 property tax bill. The 2025 tax rates were based on the budgetary requirements approved in the 2025 Business Plan & Budget.

The rates for the education portion of residents' property tax bills are determined by the Provincial government and legislated under the Education Act. The portion of your bill relating to education is collected by the municipality on behalf of the Province but is remitted to public and separate school boards for the Barrie area. No portion of revenue collected for this purpose is retained by the municipality. The Tax Ratios By-law establishes the tax ratios used to determine the relative amount of taxation to be borne by each property class.

As an Ontario property owner, you are required to support a school system even if you do not have children or your children are not currently attending school. In the case of a

residential property occupied by tenants, the tenants can direct the school support for that

property. By default, your property taxes support the English public school board. However, property owners, occupants, and tenants can change the school board that your taxes support online at mpac.ca/schoolsupport.Per By-law 2025-032 the tax ratios for the 2025 taxation year are as follows:

Residential/farm property class 1.000000 New multi-residential 1.000000 Multi-residential 1.000000 Commercial 1.433126 Industrial 1.516328 Pipelines 1.103939 Farmlands 0.250000 Managed forest 0.250000 Landfills 1.067122 Aggregate Extraction 1.233846 The above figures are included in Schedule F of the Fees By-law.

*Turnaround time is based on receipt of request during regular business hours, Monday to Friday, 8:30am–4:30pm. Payment must be received by the Service Barrie office prior to the issuance of the certificate.Fee Type Current Fee NSF/stop payment/returned cheque/funds not cleared charge (per incident) $47.00 Payment Redistribution Fee (after second occurrence)

Fee applies if a payment is to be transferred from one account to another. If you've moved or you have more than one property tax/water account, you must ensure all accounts have been individually set up for payments.$45.00 Tax Certificate (per property)

This is the most detailed tax report someone can order about a property. A tax certificate is the legal and binding document provided by municipalities that includes account information, and is used in real estate and mortgage transactions. Provided to the indicated recipient within 10 business days of receipt of request.*$78.00 Rush Tax Certificate (per property)

See description above. Provided to the indicated recipient within 1–2 business days of receipt of request.*$117.00 Duplicate Tax Bill, Statement or Receipt (per property, per year) $15.00 Tax Account Fee for Ownership Changes (per property)

If you've recently purchased, or transferred title, there is a fee to cover the costs associated with updating the tax roll.$39.00 New Account Added to Tax Roll (for new address)

If property is new to tax roll, you will incur a one-time fee to cover the costs associated with setting up the account. You will be billed separately from your tax bill.$60.00 Mortgage Company Administration Fee (for mortgage company)

per property tax account to be invoiced biannually (interim & final tax bills)$12.00 Detailed Calculations for Tax Adjustments Requested by Other Than Property Owner (per property) $27.00 Administrative Charge

Any unpaid fee or charge that has been added to the tax roll for collection purposes. Charges added to the Tax Roll.$45.00 Administrative Charge - City of Barrie Act

For collecting City of Barrie Act (1960) charges and issuing payment to developer.$160.00 Reminder Notice of Tax Arrears $10.00 Tax Appeal Application $25.00

Property Tax Documents

Depending on the purpose, you may need to request a property tax certificate, statement, receipt or duplicate bill. Learn about the different types of tax documents and how to request them.

A property tax certificate is the legal and binding document provided by municipalities that includes account information, and is used in real estate and mortgage transactions. A tax certificate reflects the current assessed owner, location and description of the real property, property account number, current levy, account balance, liens on the property and the issuance date of the certificate.

You can order a certificate by:

- Mailing a written request and cheque payable to the City of Barrie to:

City Hall

Attn: Revenue, Finance Department

P.O. Box 400, Barrie, ON, L4M 4T5 - Submitting a written request and cheque in person at Service Barrie, 70 Collier Street, Monday to Friday, 8:30am–4:30pm. The certificate will not be issued immediately.

Certificates are emailed if an email address is provided. Otherwise, the certificate will be mailed via Canada Post. Please refer to current fees for pricing information.- Mailing a written request and cheque payable to the City of Barrie to:

A property tax statement is a line-by-line breakdown of all transactions that occurred on a tax account for calendar year.

You can request a statement of account by emailing FinanceAdmin@barrie.ca and including the following information:

- address of property

- roll number

- tax year(s) requested for inclusion in statement

- confirmation of the awareness of the associated fees

Please refer to current fees for pricing information. The fee is applicable for each year contained within the statement.A tax receipt will show what has been billed and paid in a given year. A receipt can only be issued for a year in which there are no tax arrears owing.

To request a yearly receipt, please email ServiceBarrie@barrie.ca or visit ServiceBarrie.ca. Requests may take up to 2 business days for processing.

Please refer to current fees for pricing information.

For legal transactions such as home sales or mortgage refinancing, a tax certificate is required (not a receipt).

A duplicate tax bill (reprint) is an exact replica of the original and does not show payments made since the original bill was issued.

To request a duplicate tax bill, please email ServiceBarrie@barrie.ca or visit ServiceBarrie.ca. Requests may take up to 2 business days for processing.

Please refer to current fees for pricing information.

For legal transactions such as home sales or mortgage refinancing, a tax certificate is required (not a bill).

Property Tax Calculator

The City has developed a tool that provides an estimated amount of property tax you will pay and the distribution of your municipal taxes. This tool is intended for the convenience of property owners only.

A property assessment notice, which is provided by MPAC, shows the assessed value and classification of your property as of a certain date. According to MPAC, the fixed valuation date for 2025 remains January 1, 2016, which was the end of the last assessment cycle. MPAC has not done a province-wide reassessment yet.

No, they are not. According to MPAC, municipalities determine revenue requirements, set municipal tax rates, and collect property taxes to pay for municipal services, while MPAC determines property assessments for all properties in Ontario.

Each municipality across Ontario uses the Municipal Property Assessment Corporation's (MPAC) current value assessment and classification of properties to calculate municipal property taxes.

Municipal property tax is calculated by multiplying your property's current year phased-in assessment by the City's tax rate as approved by City Council. City Council sets municipal tax rates based on the revenue requirements outlined during the budget process.

Changes to your property taxes can occur due to a change in the tax rate, a change in your assessed value and/or a change in your property’s classification.

For more information on how properties are assessed and how property taxes and assessment are related, visit MPAC’s website.

There may have been an update to your property’s assessment value based on some type of change/improvement to your property. Your final 2025 tax bill reflects any changes to the assessed value of the property in the past year as it is calculated using your 2025 assessment value and the City’s 2025 tax rate. Your interim tax bill sent out earlier this year was based on 50% of the taxes you paid last year and would not be indicative any assessment increases.

According to MPAC, when there is a change in a property (such as new construction or major renovation), MPAC updates the assessment and mails a notice. The MPAC website details reasons for notices to be sent out. The 2025 assessment is what the property would have sold for on January 1, 2016—in its current state and condition, including any major changes since then.

Not necessarily. According to MPAC, when a province-wide assessment update occurs, the most important factor is not how much your assessed value has changed, but how your assessed value has changed relative to the average change for your property type in your municipality.

For information regarding your property assessment and how this relates to your taxes, please visit the Municipal Property Assessment Corporation’s First Time Homeowners' Hub.

Property tax dollars associated with any changes are retroactive to the date of occupancy or when the renovation or alterations were completed. Taxes are levied against the property and not the person. If you purchased the property after the effective date noted on the bill, please contact your lawyer directly to review and make any required adjustments with the seller of the property.

Property tax bills for newly constructed homes may only be for the land portion of the property until the Municipal Property Assessment Corporation (MPAC) is able to assess the structure (new home) on the property.

You will receive a Property Assessment Change Notice (PACN) from MPAC once your property has been assessed. The City will send a supplementary/omitted tax bill(s) for the unpaid taxes. The supplementary/omitted tax bill(s) will be retroactive to the date of occupancy or when the renovation or alterations were completed. It is recommended that purchasers start saving in preparation for these tax bills and discuss payment details for any supplementary/omitted tax bills they receive with their real estate lawyer.

If you own a newly built home in Barrie, you may not have received a property tax bill yet. The City must wait for the MPAC assessment before the tax bill can be issued. For information regarding property assessment and how this relates to your taxes, visit the Municipal Property Assessment Corporation’s First Time Homeowners' Hub.

The City of Barrie's Property Tax Deferral Program is available to any property owner aged 65 or older.

The Province of Ontario offers a Senior Homeowners’ Property Tax Grant for low-to-moderate income seniors. You may be eligible for up to $500 back on your property taxes if the specific requirements are met. Learn more about the Senior Homeowners' Property Tax Grant.

If you have questions about your assessment, please contact the Municipal Property Assessment Corporation at 1-866-296-6722 or visit www.mpac.ca.

To learn more about property assessments, visit mpac.ca.